21

Nov

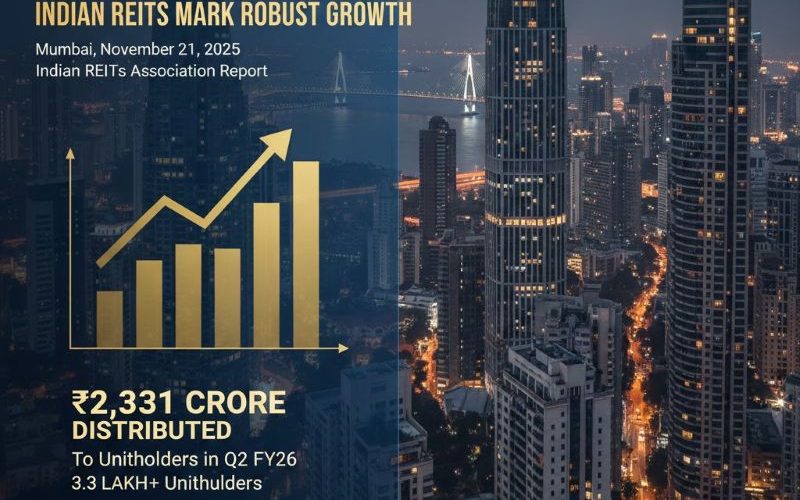

#IndianREITs #REITsIndia #RealEstateInvestmentTrust #Q2FY26Results #UnitholderDistributions #CommercialRealEstate #InvestmentNews #BrookfieldREIT #EmbassyREIT Chandigarh: India’s Real Estate Investment Trust (REIT) sector has showcased remarkable growth and resilience, with the five publicly listed trusts collectively distributing over ₹2,331 crore to more than 3.3 lakh unitholders during the second quarter of the current fiscal year (Q2 FY26). The strong quarterly performance, as reported by the Indian REITs Association, underscores the asset class's viability as a liquid and income-generating avenue for investing in commercial real estate. Sectoral Milestones and Expansion The Indian REIT ecosystem has achieved several key milestones recently: Growing Market Cap: The combined market capitalisation…