#AequsIPO #IPO #StockMarketIndia #SEBI #FreshIssue #OfferForSale #AerospaceManufacturing #MakeInIndia #PrecisionEngineering #BusinessNews #IndianMarkets

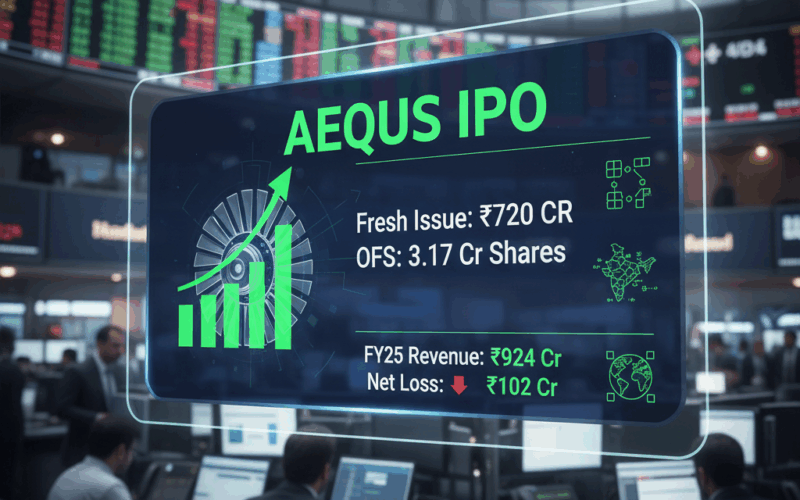

BENGALURU: Precision component manufacturer Aequs Limited has filed an updated Draft Red Herring Prospectus (UDRHP) with the Securities and Exchange Board of India (SEBI) for its Initial Public Offering (IPO). The public issue will comprise a fresh issue of equity shares aiming to raise up to ₹720 crore, alongside an Offer For Sale (OFS) of up to 31,772,368 equity shares by existing shareholders.

SEBI granted its approval for the public issue on September 18. The company is a vertically integrated precision component manufacturer with a global footprint, catering to the aerospace and consumer sectors. Its key customers in the Aerospace Segment include industry giants like Airbus, Boeing, and Safran, while in the consumer segment, it serves brands like Spinmaster and Wonderchef. Aequs operates manufacturing facilities across India (Belagavi, Hubballi, and Koppal in Karnataka), France, and the USA.

Fund Utilisation: The net proceeds from the fresh issue are earmarked primarily for:

- Repayment or prepayment of outstanding borrowings of the company and two of its wholly-owned subsidiaries, amounting to approximately ₹419.2 crore.

- Funding capital expenditure for the purchase of machinery and equipment, with ₹67.5 crore allocated for this purpose.

- Funding inorganic growth opportunities through unidentified acquisitions and general corporate purposes.

Financial Snapshot (as per reports): The company reported a total operating income of approximately ₹970 crore in FY24, with a net loss of ₹15 crore. For the first nine months of FY25, revenue stood at ₹971 crore, with the net loss significantly reduced to ₹8.8 crore, indicating improving financial performance.

JM Financial, IIFL Capital, and Kotak Mahindra Capital are the Book Running Lead Managers for the issue.

#AequsIPO #IPO #StockMarketIndia #SEBI #FreshIssue #OfferForSale #AerospaceManufacturing #MakeInIndia #PrecisionEngineering #BusinessNews #IndianMarkets