#LGElectronicsIPO #IPOIndia #StockMarketNews #PublicIssue #OFS #mfnewsdaily #IndianElectronics #RetailInvestment #CapitalMarkets

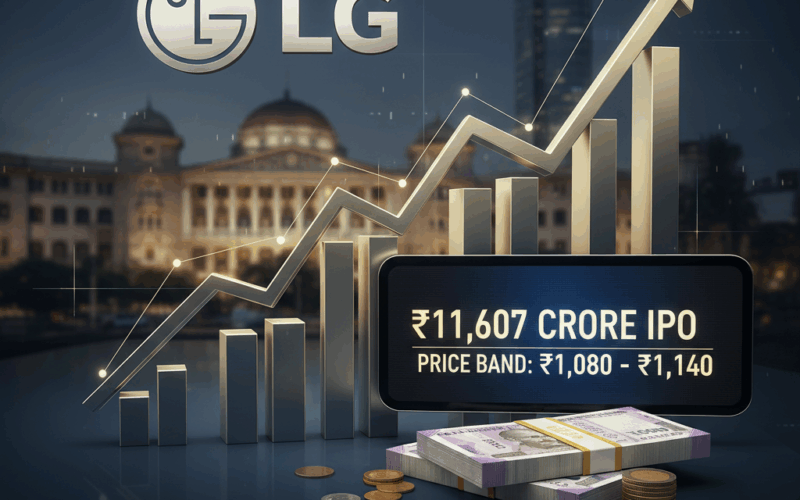

New Delhi — LG Electronics Inc.’s Indian subsidiary has officially fixed the price band for its highly anticipated Initial Public Offering (IPO). The Korean home appliances and electronics giant is seeking to raise up to ₹11,607 crore through the public issue, setting the price band at ₹1,080 to ₹1,140 per equity share.

According to a report on mfnewsdaily.in, the public subscription window will be open from October 7 to October 9, 2025. The anchor book portion, designated for institutional investors, will launch one day prior on October 6.

IPO Details and Structure

The entire ₹11,607 crore public issue is structured as an Offer for Sale (OFS), meaning the entire sum will go to the promoter, the selling shareholder. This OFS involves the sale of 10.18 crore equity shares, which is equivalent to 15% of the company’s paid-up equity. As a result, the Indian arm of LG Electronics will not receive any proceeds from the offering.

Key Dates and Investor Quotas

The IPO timeline is set to move quickly, with shares expected to be listed for trading shortly after the subscription closes:

The issue has set aside specific portions for different investor categories:

- Qualified Institutional Buyers (QIBs): 50% of the total offer size.

- Non-Institutional Investors (NIIs): 15% of the offer.

- Retail Investors: The remaining 35% of the shares.

Additionally, LG Electronics India has reserved 2.1 lakh shares for its employees, who will receive these units at a discount of ₹108 per share to the final issue price.

Minimum Investment and Financial Context

Retail investors can bid for a minimum of 13 equity shares and in multiples of 13 thereafter. This sets the minimum investment required at ₹14,820 (at the upper price band). Given the ₹2 lakh retail investment limit, the maximum application allowed for a retail investor is 169 shares (13 lots), totaling ₹1,92,660.

The company, which manufactures a wide range of consumer electronics and home appliances—including refrigerators, washing machines, and air conditioners—competes with major players like Voltas, Whirlpool, and Havells, and claims a leading market share in the offline segment in India.

However, the company reported a weak financial performance in the recent June 2025 quarter. Profit declined by 24.5% to ₹513.3 crore, and revenue fell by 2.3% to ₹6,262.9 crore compared to the same period last year. EBITDA also saw a drop of 25.2%, with margins slipping to 11.43%. Investors will weigh this recent financial performance against the company’s strong market presence as the issue opens.

The IPO is being managed by a consortium of investment banks, including Axis Capital, Citigroup Global Markets India, Morgan Stanley India Company, JP Morgan India, and BofA Securities India.

#LGElectronicsIPO #IPOIndia #StockMarketNews #PublicIssue #OFS #mfnewsdaily #IndianElectronics #RetailInvestment #CapitalMarkets