09

Jun

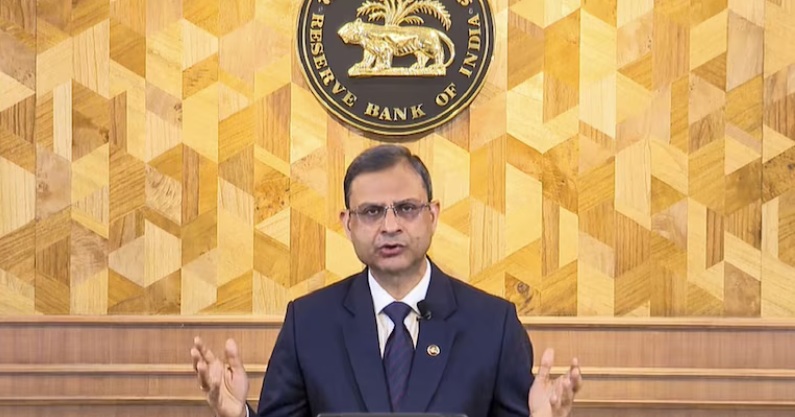

#JioBlackRockAM #JioBlackRockEarly #JioBlackRockWebsite Introduces and showcases a preview of the business proposition, providing valuable insights for investor education and engagement. Mumbai: Jio BlackRock Asset Management Private Limited (JioBlackRock Asset Management), a 50:50 joint venture between Jio Financial Services Limited (JFSL) [BSE, NSE: JIOFIN] and BlackRock* [NYSE: BLK], announces the appointment of its executive leadership team and the launch of its website along with an exclusive early access initiative. JioBlackRock Asset Management’s leadership team brings together asset management experience, digital innovation and customer-centric product design. Together, the team is set to deliver JioBlackRock’s mission to transform investing in India by making it…