12

Jul

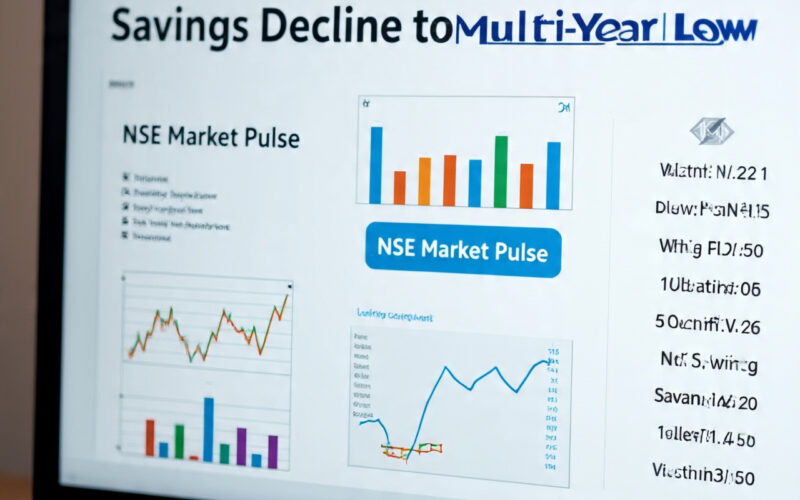

#NSEMarketPulse #घरेलूऋण #बचतमेंगिरावट #वित्तीयदायित्व #भारतीयअर्थव्यवस्था #क्रेडिटआधारितखर्च #HouseholdFinance #PostCovidTrends #वित्तीयजागरूकता #आर्थिकस्थिति #PersonalFinance #NetSavings #RisingLiabilities COVID के बाद क्रेडिट-आधारित उपभोग से वित्तीय असुरक्षा बढ़ी, विश्लेषकों की चेतावनी चंडीगढ़: भारत में घरेलू वित्तीय परिदृश्य हाल के वर्षों में काफी बदल चुका है। NSE मार्केट पल्स रिपोर्ट (जून 2025) के अनुसार, जहां एक ओर घरेलू ऋण और क्रेडिट आधारित उपभोग में तेजी देखी जा रही है, वहीं दूसरी ओर शुद्ध घरेलू वित्तीय बचत में चिंताजनक गिरावट आई है। रिपोर्ट के मुताबिक, FY12 से FY20 तक भारत की शुद्ध घरेलू वित्तीय बचत GDP का 7% से 8% के बीच स्थिर रही। लेकिन FY24 में यह…