04

Jul

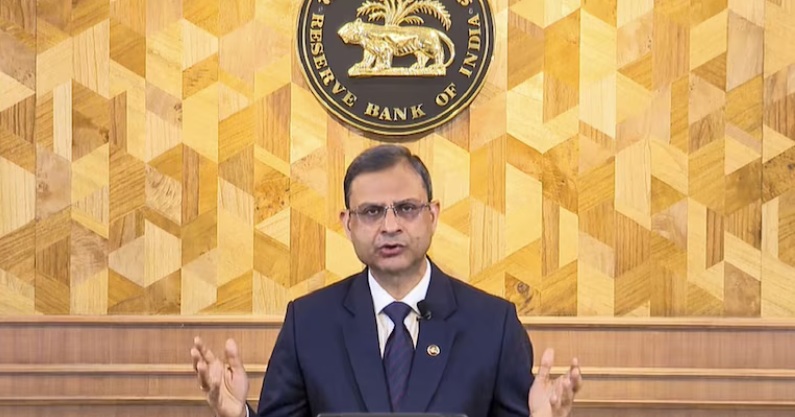

#RBI #PrepaymentFree #FloatingRateLoans #DebtFreedom #BankingReform #BorrowerBenefit #HomeLoan #PersonalLoan #MSMELending #LoanTransparency New Delhi: In a major financial policy update, the Reserve Bank of India (RBI) has issued a comprehensive directive that will waive prepayment charges on all floating-rate loans initiated on or after January 1, 2026. The move empowers borrowers with greater freedom, transparency, and flexibility in managing their debt, while also fostering competitiveness among lenders. 🚀 What’s Changing? From January 1, 2026, any borrower with a floating-rate loan—whether a home loan, personal loan, or other variable‑rate credit from a bank or regulated entity—will no longer be charged any fee for full or partial prepayments.…