#RaysPowerInfraIPO #SEBI #RenewableEnergy #SolarPower #TOPCon #GreenEnergy #IPOIndia #CleanTech #MakeInIndia #DalalStreet

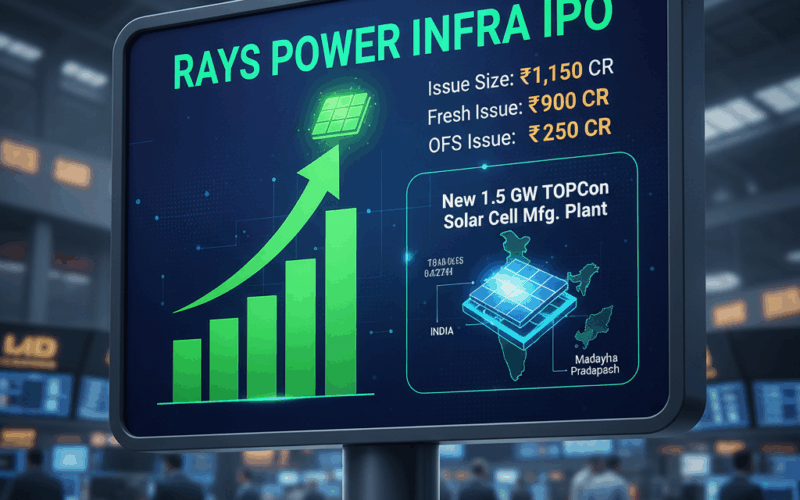

New Delhi, India – Rays Power Infra, a prominent Gurugram-based renewable energy solutions provider, has refiled its Draft Red Herring Prospectus (DRHP) with SEBI, significantly increasing the size of its planned Initial Public Offering (IPO) to ₹1,150 crore. The move marks the company’s re-entry into the primary market after an earlier withdrawal and underscores a massive push into cutting-edge solar technology manufacturing.

The revised IPO structure consists of a fresh issue of shares worth ₹900 crore, which is triple the fresh issue size of ₹300 crore planned in its earlier filing in January 2024. The issue will also include an Offer-for-Sale (OFS) component of ₹250 crore by existing shareholders, including promoters. The company may also consider a pre-IPO placement of up to ₹180 crore, which would reduce the fresh issue size accordingly.

Funding a Tech-Forward Future

The substantial increase in the fresh issue size is primarily aimed at funding a major strategic expansion. Of the fresh issue proceeds, ₹500 crore is earmarked for the establishment of a large-scale, 1.5 GW PV solar n-type TOPCon G12R cell manufacturing plant in Madhya Pradesh, to be set up through its subsidiary, Rays Green Energy Manufacturing. This investment signals Rays Power Infra’s shift towards higher-efficiency, next-generation solar technology.

Furthermore, ₹200 crore of the capital raised will be deployed to meet incremental working capital requirements, with the remaining funds allocated for general corporate purposes.

Strong Growth and Order Book

Rays Power Infra is a solar EPC (Engineering, Procurement, and Construction) company that also specializes in developing ready-to-build infrastructure for renewable power projects under its co-development model. The company boasts a significant track record, having executed and commissioned 50 renewable power projects with an aggregate installed capacity of 1,771.18 MWp.

The company’s financial performance reflects robust growth, reporting a 52.5% increase in profit to ₹139.4 crore for the fiscal year 2025 (FY25), on a revenue of ₹1,220.6 crore, up 16.4% from the previous fiscal year (FY24). Adding to its growth visibility is a massive order book, which stood at ₹8,034.3 crore as of June 2025.

Rays Power Infra competes with listed industry players such as Waaree Renewables Technologies, KPI Green Energy, Sterling and Wilson Renewables Energy, and Oriana Power.

The IPO is being managed by book running lead managers Anand Rathi Advisors and Pantomath Capital Advisors. The successful launch of this sizable IPO is expected to be a key event in the renewable energy sector, positioning the company as a major player in India’s solar manufacturing landscape.

#RaysPowerInfraIPO #SEBI #RenewableEnergy #SolarPower #TOPCon #GreenEnergy #IPOIndia #CleanTech #MakeInIndia #DalalStreet