#CleanMaxIPO #RenewableEnergy #GreenInvesting #SolarPower #WindEnergy #SustainableGrowth #EnergyTransition #IndianStockMarket #IPOAlert #CleanEnergy

Mumbai – India’s renewable energy sector is gearing up for another milestone as Clean Max Enviro Energy Limited, one of the leading players in solar and wind energy solutions, files its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its much-anticipated initial public offering (IPO). The move reflects not only the company’s ambitious expansion plans but also the rising appetite of investors for sustainable and ESG-driven (Environmental, Social, and Governance) businesses.

Background of Clean Max Enviro Energy

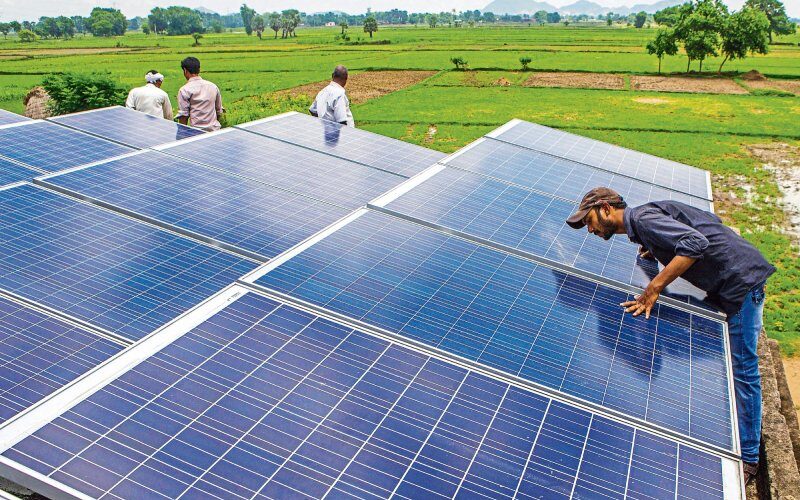

Founded in 2011, Clean Max Enviro Energy has carved a niche for itself as a pioneer in renewable energy solutions catering primarily to commercial and industrial (C&I) clients. Unlike utility-scale renewable energy firms, Clean Max focuses on helping corporates and institutions transition toward clean power through on-site rooftop solar installations, open access solar parks, and hybrid projects combining wind and solar.

Over the years, the company has developed more than 1.6 GW of renewable energy capacity across India, with clients spanning diverse industries including IT, manufacturing, pharmaceuticals, FMCG, and real estate. With sustainability becoming a global boardroom priority, Clean Max has positioned itself as a trusted partner for enterprises looking to reduce their carbon footprint and energy costs simultaneously.

IPO Structure and Objectives

According to the DRHP filed with SEBI, the Clean Max IPO will consist of a fresh issue of equity shares worth ₹1,200 crore and an offer-for-sale (OFS) of 3.2 crore equity shares by existing investors, including private equity firms and early backers. The proceeds from the fresh issue are expected to be utilized for:

-

Debt repayment and reduction of borrowings – helping the company strengthen its balance sheet.

-

Investment in new renewable energy projects – particularly solar-wind hybrid and battery storage systems.

-

Working capital requirements – to scale operations across newer states and international markets.

-

General corporate purposes – including technology upgradation, digital integration, and strengthening of its operational ecosystem.

This IPO is expected to value the company in the range of ₹8,000–₹9,500 crore, depending on market conditions and investor appetite.

Market Position and Growth Drivers

Clean Max operates in a segment that is witnessing exponential growth. India has committed to achieving 500 GW of renewable energy capacity by 2030 as part of its climate commitments under the Paris Agreement. Within this, corporate renewable procurement is expected to be one of the fastest-growing areas, driven by regulatory push, rising fossil fuel costs, and the global shift toward net-zero goals.

Key strengths of Clean Max include:

-

Diversified Portfolio – Presence across rooftop solar, open access projects, and hybrid renewable parks.

-

Strong Client Base – Over 350 corporate clients, many of them Fortune 500 companies.

-

Technology Integration – Adoption of AI-based demand forecasting, IoT-enabled monitoring systems, and smart energy management platforms.

-

Sustainability Edge – Recognized as one of India’s top green energy firms in ESG compliance and environmental stewardship.

Financial Performance

In FY2024-25, Clean Max reported revenues of ₹3,450 crore, up nearly 35% YoY, while its net profit surged to ₹420 crore from ₹290 crore in FY2023-24. The company’s EBITDA margin stood at a healthy 29%, reflecting operational efficiency and cost optimization.

The debt-to-equity ratio, however, remains on the higher side at 1.7x, a common scenario in capital-intensive renewable energy projects. With IPO proceeds earmarked for debt reduction, this ratio is expected to improve significantly, enhancing the company’s financial resilience.

Analyst Expectations and Investor Sentiment

Market analysts believe the Clean Max IPO could generate strong investor interest given the company’s:

-

First-mover advantage in the C&I renewable energy space.

-

Long-term power purchase agreements (PPAs) that provide revenue visibility.

-

Alignment with India’s green energy goals and global ESG investment trends.

However, risks include high sectoral competition from players like ReNew Power, Amplus Solar, and Tata Power Renewable Energy, along with regulatory uncertainties around open access projects.

Broader Impact on India’s Green Economy

If successful, the Clean Max listing could pave the way for more renewable energy IPOs in India. It also highlights the growing importance of climate finance and capital market participation in driving the country’s green transition.

By bringing sustainability-driven businesses into mainstream stock exchanges, investors get an opportunity not only to earn returns but also to contribute to India’s net-zero journey.

Conclusion

The upcoming Clean Max Enviro Energy IPO is more than just a financial event; it is a symbolic leap in India’s renewable energy evolution. For investors, it offers a chance to back a company operating at the confluence of profitability and sustainability. For the nation, it signals the accelerating momentum toward a cleaner, greener, and more resilient energy ecosystem.

As Clean Max enters the public market, all eyes will be on how it balances growth ambitions with its mission of powering India’s energy transition responsibly.

Suggested Hashtags:

#CleanMaxIPO #RenewableEnergy #GreenInvesting #SolarPower #WindEnergy #SustainableGrowth #EnergyTransition #IndianStockMarket #IPOAlert #CleanEnergy